As we have passed the first year of Uncle Joe’s regime, one thing should surprise us. Federal taxes have not yet increased. At least not directly.

This certainly cannot be wholly blamed on just plain Joe, of course. Unless we consider his glaring incompetence to be a reason. He and his minions (or caregivers) have certainly been trying very hard to raise billions and billions of dollars. The “Build Back Better” idea included such wonderful things as a new 15% gross receipts tax (sales tax, in other words) on business.

All of this is, we here at TPOL believe, all about getting money – making profits! (Of course, we know the mantra: governments are “non-profit” and they don’t “make money” – but we reject that as the hooey that it is.)

Today, let us (literally) talk about highway robbery.

For example, we can quite handily quote the civics textbook answer about federal excise taxes on gasoline and diesel. It is actually a “fee” because all the money goes into “highway user trust funds” and is ALWAYS used to fund the construction and maintenance of highways: not just Interstate and US Highways, but State and county and even municipal highways, roads, and streets. Again, hogwash.

The FedGov (and the States, and yes, the counties and cities and towns and townships) all skim their percentage off the top. It isn’t that the contractors (and their suppliers and employees) or even the guys in government jobs that actually drive the trucks and pick up the dead deer and fill the potholes and clean the signs that get all the money. It is the bureaucrats: middle and upper management – including political appointees – and the bean-counters and all the rest. Which often means the politicians themselves. (After all, why do they pick THOSE people for the political plum jobs? Campaign donors! And what do all those unionized government employees’ unions do with a lot of their dues? Campaign donations!)

And that doesn’t count the bucks that Congress and all the State legislatures “earmark” out of the fuel tax revenues to all the boondoggles. Things like public transit, like bicycle lanes, like hiking trails, and like public art on the highways – those awful pieces of “artwork” that adorn so many places. To say nothing of vainglorious “Welcome to the most wonderful city in the Universe” signs and monuments.

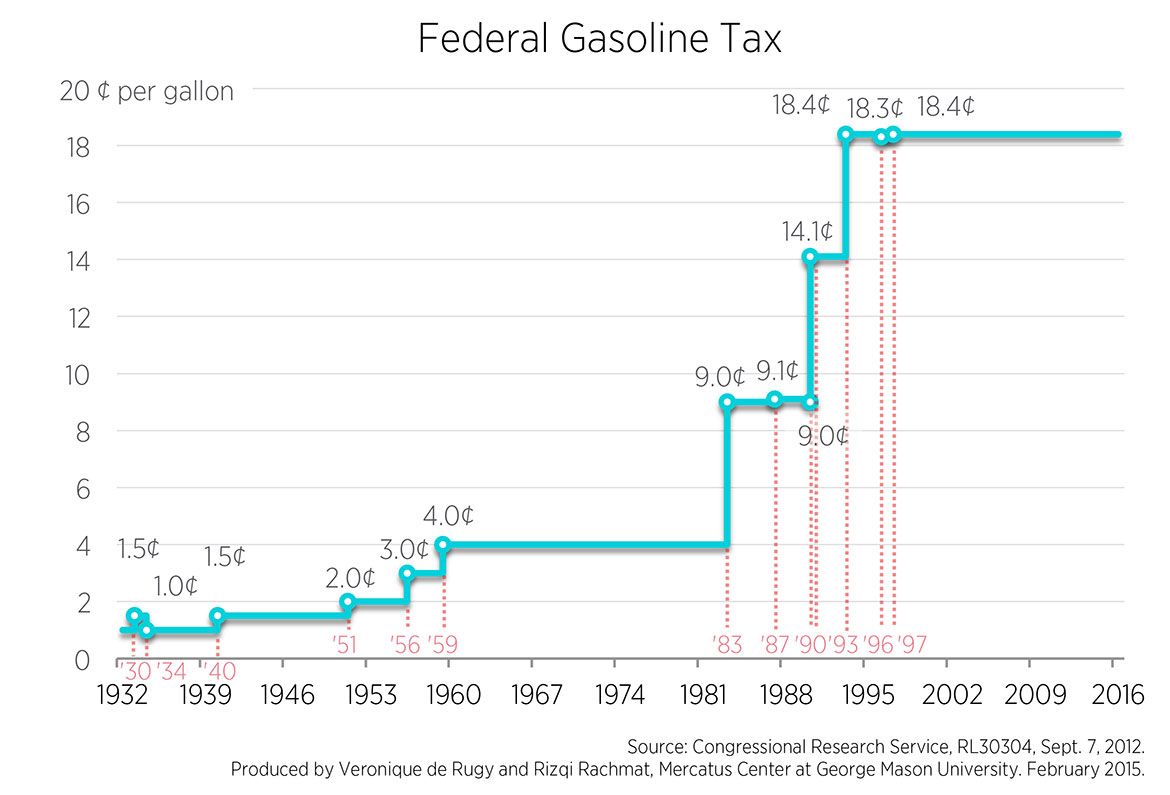

Indeed, as the chart above shows, the FedGov has raked in billions and billions since way back in 1932. Ninety years of profit. Indeed, the FedGov makes MORE money from a gallon of diesel or gasoline than the actual station that you buy your fuel at does. Or the jobber or the hauler or the guys and gals that actually own the oil before it is pumped out of the ground. And possibly more profit than even Big Oil makes on production and processing.

(Of course, remember that one of the BIGGEST landowners and recipients of royalties for oil production in these Fifty State is… ta-ta! The Federal Government.

And of course, for totally unsupportable reasons, gas- and diesel-guzzling vehicles must be replaced by electrical vehicles. Again, despite all the hash-slinging about manmade global warming and other air pollution and spills and contamination and all that, I suspect that the Fed- and State-gov lust for money is also a big part of this. After all, as Washington State is already doing, fuel taxes will be replaced by per-mile fees to pay for the roads. BUT… That electricity you are taking from your house, your business, or the growing number of charging stations is TAXED too! And sometimes double-taxed.

It is a sweet little hustle – trillions of bucks. Sweet for everyone but us suckers who have the money sucked out of our wallets.

Sir: you made one mistake. All federal gas tax goes into the federal general fund, then congress give some of the money to the Dept of Trans. North Carolina gas tax money goes into the state general fund and the general Assembly give some to that state Dept of Trans. I use to work for the feds and I ran for a state office

LikeLike

It is a very complex system (intentionally, due to politics and that good old government game of pulling the wool over our eyes). “Officially” many of the Federal Excise Taxes (FET) are earmarked for these various trust funds – it is “the law.” But practically they are nothing more than bookkeeping entries and it’s all one big pot. Besides, Congress can raid any of these trust funds at will.

I know nothing about North Carolina, but in the several western States I do keep up on, these taxes really are put into separate highway and aviation funds which are used only for those specific purposes. And for the most part, the various legislatures DO at least pay lip service to not using those funds for other things. Even States like Colorado, where the General Assembly routinely steals money from special dedicated funds to shore up the General Fund, they at least play the game. (For us here at TPOL, the most bitter example of this was Colorado’s landfill emergency response/cleanup fund about 15 years ago. The fund was built up by a per-ton fee collected on trash delivered to landfills. It was fairly large at the time, as there had been any serious problems at landfills for several years. The General Assembly “needed” the money for whatever, and officially transferred the total amount into the General Fund, zeroing out the balance. Then, adding insult to injury, the General Assembly RAISED the per-ton fee (doubling it, as I recall) because the fund had been “depleted” and had to be built back up! We know at least one county whose Commissioners refused to pay the fee to the State for several years as a protest against this theft.

Anyway…

FROM THE BROOKINGS INSTITUTION WEBSITE “TaxPolicyCenter.org” –

Excise taxes dedicated to trust funds finance transportation as well as environmental- and health-related spending. The Highway Trust Fund and the Airport and Airway Trust Fund account for over 90 percent of trust fund excise tax receipts, mostly from taxes on gasoline and other transportation fuels (Highway Trust Fund), and air travel (Airport and Airway Trust Fund).

EXCISE TAXES DEDICATED TO THE HIGHWAY TRUST FUND

Highway-related excise tax revenue totaled $40.5 billion in 2019, 41 percent of all excise tax revenue. Gasoline and diesel taxes, which are 18.4 and 24.4 cents per gallon, respectively, make up over 90 percent of total highway tax revenue, with the remaining from taxes on other fuels, trucks, trailers, and tires. (The tax rates for gasoline and diesel include a 0.1 percent tax earmarked for the Leaking Underground Storage Tank Trust Fund.) Most other motor fuels are also subject to excise taxes, although “partially exempt” fuels produced from natural gas are taxed at much lower rates. Tax credits for producers of certain fuels deemed environmentally superior—including biodiesel, renewable diesel mixtures, alternative fuel, and alternative fuel mixtures—expired at the end of 2017 but were generally extended in December 2019 retroactively from 2018 through end of 2022, except for the alternatives fuels credit was extended only through 2020.

EXCISE TAXES DEDICATED TO THE AIRPORT AND AIRWAY TRUST FUND

Revenue from excise taxes dedicated to the Airport and Airway Trust Fund totaled $16.0 billion in 2019, accounting for 16 percent of all excise tax receipts. According to Congressional Budget Office data, more than 90 percent of aviation excise taxes came from taxing passenger airfares, with the remaining coming from taxes on air cargo and aviation fuels.

That is the “official line” but as you point out, in reality, everything that is vacuumed out of our wallets – or snatched from the future via the time machine of “borrowing” – is all in one big pot which the 435 low-lifes of Congress can waste however they want.

LikeLike

Inflation is the hidden tax that is in everything you have to purchase; fuel, electricity, food, etc. “They” blame the corporations but that all supplies the grift that gets back to them without a vote or a budget. That “grift” is the new tax system.

Over seas production brings profit and thus grift while the employee gets taxed to provide crumbs to the families of those unemployed by that system. You get to pay for the new electric system for the “sparky cars” as well as for the parasites on the system. You will pay off student debt for those who learned nothing while living large on your sweat. But there will be no increases in “taxes”. And don’t expect any help for your family or community.

LikeLike